Your Guide to Unfreeze Credit Report at All Three Bureaus

If you’re wondering, 'How do I unfreeze my credit?' the answer is yes—it’s as easy as logging into your account, verifying your identity, and selecting the option to lift the freeze!

You know how it goes—you freeze your credit to protect yourself from identity theft or misuse. Smart move, right? Absolutely. But then life happens, and maybe it’s time to apply for a loan or finally buy that car you’ve been eyeing. The good news? Unfreezing is just a matter of following a few straightforward steps. In this blog, we’ll cover how to unfreeze your credit with each bureau and make the process stress-free.

Tap into the future of credit repair with our AI-driven solutions

Get StartedBut first, why would you even unfreeze credit in the first place? Well, there are times it is necessary to do so. Let’s go over them.

When to Unfreeze Your Credit Report

| Scenario | Reason to Unfreeze | Details |

| Applying for a Loan or Mortgage | To allow lenders to access your credit history for approval. | Lenders need to review your creditworthiness for loan approval. |

| Applying for a Credit Card | Credit card issuers need access to your report to determine eligibility. | Without unfreezing, your application may be denied due to lack of access to your report. |

| Renting an Apartment | Landlords often check credit reports before approving rental applications. | A frozen credit report can prevent landlords from completing the screening process. |

| Applying for a Job | Some employers check credit reports as part of their background checks. | Unfreezing ensures they can verify your financial responsibility if required. |

| Opening a New Utility Account | Utility companies may check credit to determine deposit requirements. | This applies to services like electricity, internet, or phone connections. |

| Purchasing Insurance | Insurers may review your credit to assess premium rates. | Especially common for auto or homeowner insurance policies. |

| Switching or Opening a New Bank Account | Some banks may run a credit check when opening accounts or offering overdraft protection. | Ensures a smoother account opening process. |

| Suspicious Activity Detected | To verify that no fraudulent activity is taking place on your account. | Temporarily unfreezing can help investigate and resolve issues with identity theft. |

| Rebuilding Credit | To allow creditors to report your positive credit activity. | Keeping your report frozen may delay updates to your credit score. |

| Applying for Government Benefits | Some government agencies may need access to your credit report for verification. | This could include verifying your identity for unemployment benefits or other assistance. |

| Buying a Car on Finance | Auto lenders will require a credit check before approving a loan or lease. | Ensures a faster approval process when applying for auto financing. |

Well, now that you know when to unfreeze your credit, let’s get to the real question: how to unfreeze credit. It’s simple. But before you do, you should know that there are different types of credit unfreezes.

Types of Credit Unfreeze

Unfreezing your credit can be done in three distinct ways, each designed for specific scenarios:

Temporary Lift:

- Best For: One-time needs like applying for a loan, credit card, or specific creditor checks.

- How It Works: Specify the creditor or set a time period during which the freeze is lifted.

- Timeline: Automatically reverts to frozen after a set duration (typically 7–30 days).

- Benefits: Maintains security while offering flexibility for specific needs.

Partial Unfreeze:

- Best For: Situations where only one creditor or a specific credit bureau needs access to your credit.

- How It Works: Request an unfreeze from one credit bureau, keeping others locked.

- Timeline: Remains unfrozen with the selected bureau until you request another freeze.

- Benefits: Minimizes risk by securing other credit bureaus while granting limited access.

Complete Unfreeze:

- Best For: Long-term needs like multiple applications or financial planning requiring unrestricted credit access.

- How It Works: Submit unfreeze requests to all three bureaus to lift the freeze entirely.

- Timeline: Stays unfrozen unless you refreeze your credit.

- Benefits: Eliminates restrictions, ensuring smooth processing for any credit-related activity.

There you go! This should give you a clearer picture of credit unfreezing and help you figure out which one works best for your needs.

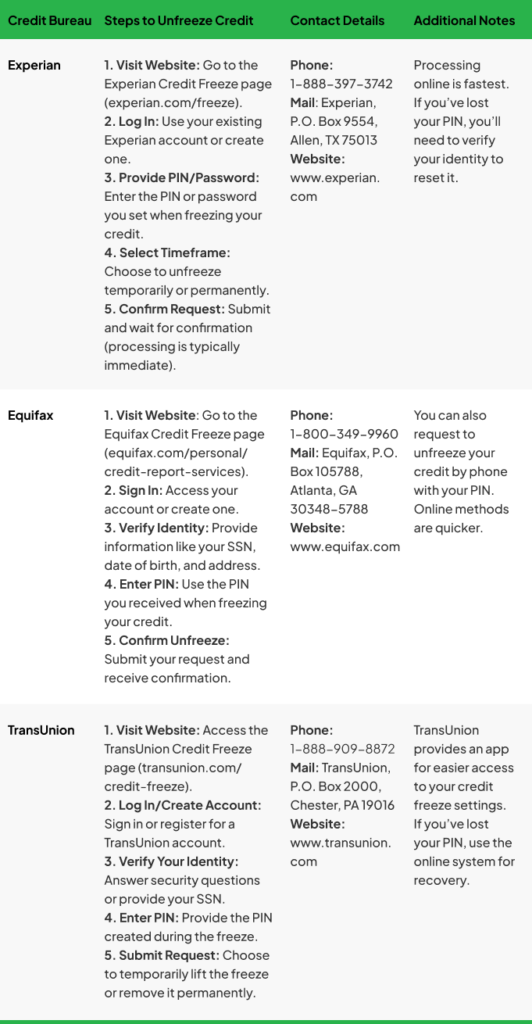

How to Unfreeze Credit: All Three Bureaus

If you’re been searching for answers to ‘How do i unfreeze my credit’ and ‘How to unlock credit freeze’, this is your quick guide. We’ve

Dos and Don'ts of Credit Unfreezing

Another thing to keep in mind when looking for the answer to ‘How to Unfreeze Your Credit Report at All 3 Credit Bureaus’ is the dos and don’ts.

| Dos | Don'ts |

| Keep your PIN/password for the credit freeze secure and accessible. | Don’t share your PIN/password with others or leave it unsecured. |

| Verify the credit bureau’s website or contact information to ensure legitimacy. | Don’t use third-party or unverified websites to unfreeze your credit. |

| Check the specific requirements for unfreezing with each credit bureau (Experian, Equifax, TransUnion). | Don’t assume all bureaus have the same unfreezing process. |

| Plan ahead and unfreeze your credit a few days before applying for loans or credit. | Don’t wait until the last minute, as unfreezing may take time to process. |

| Monitor your credit report after unfreezing to ensure no unauthorized activity. | Don’t forget to re-freeze your credit if it’s no longer needed to remain unfrozen. |

| Keep copies of any confirmations or receipts after lifting the freeze. | Don’t assume the freeze has been lifted without confirmation. |

Enhance your credit the smart way Tap into AI credit repair app

Download the AppHow to Protect Your Credit After the Unfreeze

Once you unfreeze your credit, it’s imperative to take even more stringent measures to protect it. Being proactive about monitoring and safeguarding your credit can save you from potential risks and identity theft. Here's how you can do it:

▪ Credit Monitoring

Keep a close eye on your credit activity to spot any suspicious transactions or inaccuracies. Using an app like CoolCredit makes this seamless by offering real-time alerts and insights, ensuring you’re always in the loop.

▪ Use Strong Passwords and Secure Logins

Ensure that your accounts, especially with credit bureaus, are protected by unique and strong passwords. Add two-factor authentication wherever possible for extra security.

▪ Limit Sharing of Personal Information

Be cautious about where and with whom you share sensitive details like your Social Security number or credit card information.

▪ Check Your Credit Reports Regularly

Request free credit reports from each bureau to ensure there are no errors or unauthorized activities.

▪ Re-Freeze When Necessary

If you don’t need ongoing access to your credit, consider re-freezing it for maximum protection against fraud.

Conclusion

And there you have it—a comprehensive guide to unfreezing your credit and keeping it protected afterward. Whether you’re applying for a loan, renting an apartment, or simply staying ahead of any potential credit mishaps, unfreezing your credit doesn’t have to be a headache. Just follow the steps, choose the type of unfreeze that fits your needs, and stay vigilant with tools like CoolCredit.