What Are Derogatory Marks On Your Credit Report And How Can You Fix Them?

Did you know? A derogatory mark on your credit report can drop your credit score by up to 200 points.

Baffling, isn't it? That's not all, these derogatory marks can remain on your credit report for up to ten years or more, depending on what type they are. And just the name should be enough for you to understand it isn't a good thing to have on your credit report.

So, what is a derogatory mark? What leads to these derogatory marks on credit reports? Can derogatory marks on credit reports be removed? Is it possible to rebuild credit despite these derogatory marks? In this blog, we'll clearly define derogatory marks and discuss how to fix derogatory marks on credit reports.

What Is the Meaning of Derogatory in the Credit World?

As you may well know, "derogatory remarks" are often intended to criticize someone. If you type in ‘derogatory’ meaning on Google search. The search engine will show you different synonym variations, to mention a few—belittling, disparaging, unfavorable, and even negative. Well, in the credit world, it’s more or less the same. Derogatory marks are made to underscore someone's bad credit behavior. Simply put, these derogatory marks on credit reports are negative items like missed payments, bankruptcies, or foreclosures. Consequently, they can drastically lower your credit score.

Elevate Your Financial Profile with Expert AI Credit Repair

Learn HowWhat Leads To Derogatory Marks On Credit Report?

- Missing payments or paying late due to oversight or financial strain.

- High credit card balances and maxing out cards relative to credit limits.

- Unforeseen hardships like job loss, medical emergencies, or unexpected expenses.

- Identity theft leads to unauthorized charges and financial disruption.

- Defaulting on loans, ignoring lender communication, and not seeking assistance.

- Bankruptcy declaration as a result of overwhelming debt.

- Foreclosure due to inability to make mortgage payments.

- Repossession of collateral following default on secured loans.

- Legal actions such as civil judgments or liens for unresolved financial issues.

- Neglecting to check credit reports for errors, fraud, or signs of financial trouble.

- Ignoring debts and avoiding communication with creditors.

Types of Derogatory Marks and Their Impact on Credit Scores

| Type of Remark | Description | Credit Score Impact |

| Late Payments | Failure to make timely payments | 30-150 points |

| Collection Accounts | Accounts sent to collections due to non-payment | 50-200 points |

| Charge-Offs | Unpaid debts, written off as losses by creditors | 50-200 points |

| Bankruptcy | Legal declaration of inability to repay debts | 100-200 points |

| Foreclosure | Legal process of repossessing of property due to default | 85-160 points |

| Repossession | Seizure of collateral due to default on a loan | 60-130 points |

| Public Records | Legal judgments, tax liens, and bankruptcies | 50-200 points |

How Long Does a Derogatory Stay on Your Credit Report?

| Derogatory Item | Time on Credit Report |

| Late Payments | Up to 7 years from the initial late payment |

| Charge-Offs | Up to 7 years from the first payment leading to charge-off |

| Collections | Up to 7 years from the date of original delinquency |

| Bankruptcy (Chapter 7) | Up to 10 years from the filing date |

| Bankruptcy (Chapter 13) | Up to 7 years from the filing date |

| Foreclosure | Up to 7 years from the first missed payment leading to foreclosure |

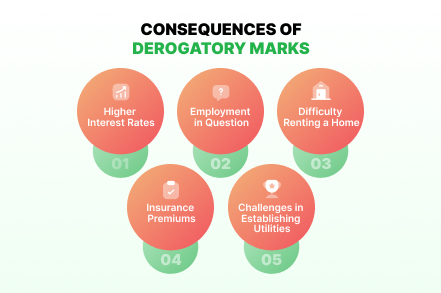

The Consequences of Derogatory Marks on Future Finances

Derogatory marks on your credit reports can get you in the bad books of many, after all, not many are willing to lend credit to someone with a bad credit history. Moreover, the consequences extend beyond just a reduced credit score, limited access to credit, and lower approval rates; they include:

- Higher Interest Rates: Let's say you are approved for credit despite having derogatory marks on your credit report, you'll still be considered a higher-risk borrower. Consequently, you may incur higher interest rates on loans and credit cards.

- Employment in Question: You may be surprised to know that some employers check credit reports as part of the hiring process, especially for positions involving financial responsibilities. In such cases, derogatory marks may come off as a sign of irresponsibility and impact your chances of securing a job.

- Difficulty Renting a Home: Derogatory marks on your credit report may make it harder for you to secure a rental property of your choice. Yes, landlords and property management companies often check credit reports as part of the rental application process. That's not all, you may also have to pay a higher security deposit.

- Insurance Premiums: You should know that some insurance companies use credit information to determine premiums. This means if you have derogatory marks on your credit report, you may have to pay higher premiums for auto or homeowner insurance.

- Challenges in Establishing Utilities: Many providers may also check your credit before setting up utilities for a new residence. Derogatory marks on your report may condition you to deposit a higher amount.

How to Get Derogatory Marks Removed From a Credit Report?

- Check Your Credit Report: First things first, you must check your credit reports regularly to identify any derogatory marks. Retrieve and review your credit report from each of the three major credit bureaus. You can do so easily through an app like CoolCredit.

- Identify Derogatory Marks: Once you get hold of your credit reports, pinpoint and define derogatory marks. They may include late payments, charge-offs, bankruptcies, and collections.

- Dispute Inaccuracies: If at all you find any inaccuracies or errors in the derogatory marks, dispute them immediately. There's no need to let go of crucial credit points over negligence. Create evidence-based dispute letters and send them to the respective bureau. You can take the help of a DIY credit repair tool that also generates impactful disputes through AI technology.

- Negotiate a Pay-for-Delete Agreement: Even if the derogatory mark is legitimate, don't lose hope, there are ways to redeem yourself. For one, you may negotiate with the creditor to remove it in exchange for payment. This is an ideal option if you missed a payment because of plain oversight and can pay off the amount immediately.

- Write a Goodwill Letter: Another thing you can do is explain your situation to the creditor through a goodwill letter and request them to remove the derogatory mark. This is likely to be successful in cases where negative information resulted from a one-time event, and you have a rather satisfactory payment history.

- Seek Expert Assistance: If all else fails, or you can't decide which way to go about it, you can always seek expert assistance. CoolCredit, a trusted ai credit repair, offers an 'Expert Assist' feature to people. This feature allows you to seek professional help and navigate your credit repair journey smoothly.

Unlock Your Financial Potential — Try Our AI Credit Repair App Today!

Download NowAvoiding Derogatory Marks to Begin With

It's wiser to avoid derogatory marks in the first place than to wonder how to fix derogatory marks on your credit report. Especially when you know the answer to—how long does a derogatory stay on your credit report? Even though some derogatory marks are a result of unprecedented circumstances, others can be that of plain oversight. So, how do you avoid derogatory marks on credit reports? Firstly, manage your finances responsibly. Secondly, take bills seriously. And finally, use credit wisely.

Tips to Avoid Derogatory Marks:

✅ Pay bills on time to avoid negative marks on your credit report.

✅ Create a budget to manage finances, set spending limits, and prevent financial stress.

✅ Build an emergency fund to cover unexpected expenses and avoid reliance on credit cards.

✅ Set up reminders or use automatic payments to avoid missing due dates.

✅ Regularly monitor your credit report for inaccuracies or unauthorized activity.

✅ Reduce outstanding debts, especially credit card debt, to positively impact your credit score.

✅ Use credit wisely; avoid opening too many new credit accounts in a short period.

✅ Seek help from reputable credit counseling agencies or try your hands at a DIY Credit Repair App like CoolCredit.

How to Rebuild Your Credit After Derogatory Marks?

Say, due to unprecedented circumstances, a derogatory mark is added to your credit report, what then? Well, firstly, don't panic. Secondly, know that you can still rebuild credit despite the derogatory marks, over time.

- Retrieve and thoroughly review credit reports from Equifax, Experian, and TransUnion, disputing any errors you find.

- Address delinquent accounts by negotiating repayments with creditors.

- Make all future payments timely to rebuild your credit score.

- Reduce credit card balances, especially if close to the credit limit.

- Consider a secured credit card to rebuild credit responsibly.

- Diversify your credit mix by adding installment loans strategically.

- Negotiate pay-for-delete agreements with creditors or collection agencies.

- Be patient and committed; rebuilding credit takes time.

You may find the theory simpler than the practice. However, following the rulebook, maintaining discipline, and being patient make it simple. Nonetheless, having your doubts is part of the process, and having them cleared, even more so. You need a resourceful DIY, AI-assisted Credit Repair App like CoolCredit to simplify the process. The app will allow you to retrieve and review credit reports from all three bureaus, identify and dispute inaccuracies, and monitor your progress. Additionally, as mentioned earlier, it also offers you the option to seek expert assistance. Learn more about CoolCredit here.

Conclusion

Understanding and addressing derogatory marks on your credit report is crucial for maintaining financial health and securing future opportunities. Moreover, these negative entries can significantly impact your credit score and have far-reaching consequences. Resultantly, taking proactive measures to address them is critical. Remember, the process may seem challenging, but with discipline and the right tools, such as CoolCredit, dealing with derogatory marks becomes a simple matter.

FAQs

Q: How Often Should I Check My Credit Report for Derogatory Marks?

A: It's best to check your credit report from each bureau regularly, or at least annually, to define derogatory marks and address them promptly.

Q: What Is the Impact of Late Payment Derogatory Marks on My Credit Score?

A: Late payments can lower your credit score by 30-150 points, depending on the severity and frequency.

Q: Can a Goodwill Letter Really Help in Removing Derogatory Marks?

A: Yes, a sincere, well-crafted goodwill letter explaining a one-time event may convince creditors to remove negative marks from your credit report.

Q: Is It Possible to Negotiate a Pay-for-Delete Agreement With Creditors?

A: Yes, given that you do it with the right approach in the right manner, negotiating a pay-for-delete agreement with creditors is possible. It involves settling the debt in exchange for the removal of the derogatory mark.

Q: What Is the Quickest Way to Start Rebuilding Credit After Derogatory Marks?

A: There's no shortcut. Rebuilding credit in such cases requires making timely payments, reducing credit card balances, and diversifying your credit mix, all of which may take a while.