Credit Lock vs Freeze: How They Differ and What to Choose

Credit Lock vs Freeze

Credit freezes are legally free and need a PIN or password to unfreeze, whereas credit locks are typically paid and unlockable via an app or online portal.

If you're constantly searching about credit lock vs freeze, dive into our blog to find out. Even if they are not the same, credit locks and credit freezes are both powerful tools to safeguard your credit. Both restrict access to your credit report, preventing scammers from opening accounts in your name. While often used interchangeably, what's the difference between credit lock and credit freeze is crucial for making the best choice to protect your credit reports.

So, first, let’s understand these terms!

Credit Freeze

In simple terms, when you place a freeze on your credit with the credit bureaus, you essentially block any access to your credit report. Resultingly, making your credit report invisible to most lenders. Moreover, it adds a layer of protection that prevents unauthorized entities from opening new credit accounts in your name.

To unfreeze your credit, you'll likely need to provide a PIN or access through a password-protected account. You can usually initiate a credit freeze online or by phone in just a few minutes. However, the process of fully applying the freeze can take some time.

Your Credit Deserves a Smart Upgrade Repair Smarter with AI Now!

Start NowCredit Lock

By locking your credit, you can prevent unauthorized access to your credit reports. Therefore, making it harder for others to open accounts in your name. Many credit bureaus offer this service for a fee, bundling it with features like fraud alerts, identity theft protection, and fraud resolution assistance.

When you need access, you can easily unlock your credit through an app or website. Additionally, you get notifications for any changes to your report or access attempts.

Credit Lock vs Freeze: Key Differences

| Basis | Credit Lock | Credit Freeze |

| Ease of Use | Managed online or through a mobile app for quick locking/unlocking. | Requires formal requests to lock or unlock, which may take time. |

| Cost | Often part of paid services, including fraud protection packages. | Free, as mandated by federal law in the U.S. |

| Activation Timing | Online or phone requests are completed within one business day, while mail requests take up to three business days. | One to 24 hours |

| Deactivation Timing | For online or phone requests, the process is typically done in under an hour, but mail requests may take up to three business days. | Depends upon the credit bureau and the method you use. |

| Legal Protections | Not legally binding but often backed by the credit bureau’s policies. | Governed by federal laws, offering stronger legal protections. |

| Notification | Usually includes alerts for attempts to access your credit report. | Notifications depend on the credit bureau’s policies. |

| Additional Features | May bundle identity theft insurance and fraud resolution services. | Solely focused on restricting access to the credit report. |

| Best For | Those who want flexibility and are ready to pay the fee. | Those seeking a free and legally enforceable solution. |

Important note:

Locking vs freezing credit completely restricts access to your credit report. Still, entities like the following can view it:

- You, when monitoring your credit.

- Existing creditors and subscription services you use.

- Debt collectors.

- Insurance providers or employers when you apply for coverage or jobs.

- Government bodies require your financial details.

How To Freeze Your Credit?

To freeze your credit, you’ll need to contact all three major credit bureaus: Experian, Equifax, and TransUnion.

Generally speaking, the entire process takes less than 30 minutes. Ensure you have the following details available: your correct address, Social Security number, birth date, and other identifying details. Most importantly, create a PIN for managing your credit freeze and keep it secure.

Contact details of credit bureaus:

| Mode | Experian | Equifax | TransUnion |

| Online | Experian Credit Freeze | Equifax Consumer Services Center | TransUnion Service Center |

| Phone | (888) 397-3742 | (888) 298-0045 | (800) 916-8800 |

| Experian Security Freeze P.O. Box 9554 Allen, TX 75013 | Equifax Information Services LLC P.O. Box 105788 Atlanta, GA 30348-5788 | TransUnion P.O. Box 160 Woodlyn, PA 19094 |

How To Unlock Credit Freeze

Unlocking a credit freeze is often referred to as "thawing" your credit. The process is very similar to freezing credit, however, the result is different. It allows creditors or other entities to access your credit report for a specified period or indefinitely.

Steps to unlock a credit freeze

- Contact the Credit Bureau: Reach out to the credit bureau where your credit is frozen. If your credit is frozen at all three major bureaus, you'll need to contact each one separately.

- Provide Personal Information: Have your personal details ready, such as:

- Full name

- Social Security number

- Address

- Date of birth

- Use Your PIN or Password: When you initially set up the freeze, you create a PIN or password. This is required to authenticate your identity and lift the freeze.

- Specify the Duration: Indicate whether you want to:

- Lift the freeze temporarily (e.g., for a specific creditor or time period), or

- Remove it permanently.

- Choose the Method: You can choose among the following methods:

- Online through the credit bureau’s portal.

- By phone using their customer service number.

- Through a written request.

- Wait for Confirmation

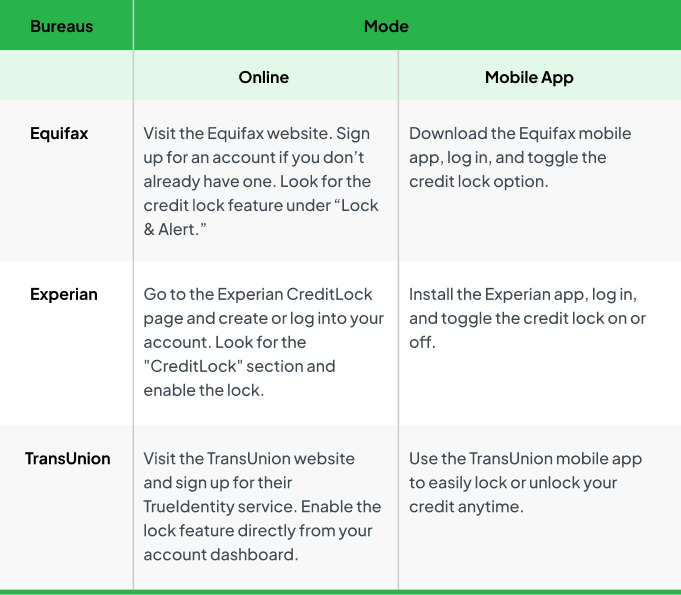

How to Lock Credit at Each Bureau?

Locking your credit restricts access to your credit reports, protecting you from identity theft or fraudulent account openings. Unlike a credit freeze, a lock is usually managed via a credit bureau’s mobile app or website and may include additional features.

Here's how you can lock your credit with each of the three main bureaus:

How To Unlock Your Credit

Unlocking your credit report is a straightforward process. Go to the credit bureau’s website or app, navigate to the credit lock section, and change the setting from locked to unlocked with a single click.

When To Use a Credit Lock vs Freeze

▪ Credit Lock

Opt for it if you prioritize convenience and are willing to pay for extra features like fraud alerts and identity theft insurance.

▪ Credit Freeze

Choose this if you prefer a no-cost, straightforward way to secure your credit report against unauthorized access.

Both are effective tools for safeguarding your financial health, so your choice depends on your preferences and needs.

Credit Repair, Simplified and Smart. Take the Leap Today!

Explore NowKeep a Check on Your Credit Reports With the CoolCredit App!

The CoolCredit app gives you the ability to check and monitor your credit reports, helping you spot any signs of fraud or unexpected activities. Therefore, you can make a better decision on what to choose—“Credit lock vs Freeze”

But that's not all – CoolCredit also helps you boost your credit score. With its booster payment plan, making on-time payments will improve your payment history and steadily increase your score. The best part? You can keep boosting your score multiple times, ensuring your credit grows stronger.

Give it a try!

Conclusion

Gaining a solid understanding of credit lock vs freeze is important when deciding which one best suits your needs. Both prevent unauthorized access to your credit report, ensuring new accounts can’t be opened in your name.

The best part—managing them online makes the process quick and efficient for blocking credit applications, whether they are legitimate or fraudulent. Although, going through this process does not guarantee that you can’t become a victim of identity theft.

FAQs

Q: Do You Have to Pay to Lock Your Credit?

A: No, you typically do not have to pay to lock your credit with major credit bureaus. Credit locking is a free feature offered by bureaus like Experian, TransUnion, and Equifax.

Q: Is Locking Your Credit Report the Same as Freezing It?

A: Locking and freezing your credit report both block access to protect against fraud, but they aren’t the same. Credit freezes are free and legally mandated, while credit locks offer convenience and instant control, often bundled with paid services. Choose based on your preference for ease or regulation.

Q: Who Can Access a Frozen or Locked Credit Repair?

A: Even with a frozen or locked credit report, some entities can still access it. These include you, creditors with existing relationships, collection agencies, government agencies, and companies reviewing your credit for employment or insurance purposes.

Q: How to Apply for a Credit Lock or Credit Freeze?

A: To apply for a credit lock or freeze, visit the websites or apps of the major credit bureaus—Equifax, Experian, and TransUnion. Provide your personal details, verify your identity, and follow the steps to set up the lock or freeze.