Building Credit With a Secured Credit Card: A Complete Overview

Secured credit cards are a smart way to build or rebuild your credit, especially if traditional credit options aren’t available. With a secured card, you’ll put down a refundable security deposit, which acts as your credit limit. This small but mighty line of credit can help you establish a positive credit history when used wisely.

How Does a Secured Credit Card Work?

A secured credit card works just like a credit card but with a difference - you’ll have to deposit a security first. When you have poor credit or a limited credit history, lenders might see you as a risky borrower. This is where a secured credit card can be a game-changer. The security deposit you provide acts as a safety net for the lender—if you default on your credit obligations, they can use your deposit to cover the costs.

Advantages of a Secured Credit Card

Check out the table below to see how a secured credit card can work to your advantage:

| Advantage | Description |

| Build or Rebuild Credit Quickly | Can help improve your credit score in as little as two months with responsible use. |

| Potential to Upgrade to Unsecured Card | Some issuers let you switch to a regular, unsecured card once you show you can manage credit responsibly. |

| Refundable Security Deposit | Your deposit is refundable as long as you repay your balance in full. |

| Easier Qualification | Easier to qualify for, even if you have poor credit or a limited credit history. |

Boost Your Credit Instantly with AI-Powered Insights!

Unlock AI RepairHow to Build Credit on a Secured Card?

Can a secured credit card help build credit? Yes, it can, but depends on how you use it. Here are some basics to get you started with building credit with a secured credit card:

- Select the right card

The basics of building credit stay the same: choose the secured credit card that reports to the major credit bureaus Experian, TransUnion, and Equifax. This makes sure your on-time payments show up on your credit report!

- Cover the security deposit

Paying the security deposit is the next step after you apply for a secured card and get approved for it. Ensure that you pay the security deposit within a certain time as failing to do so can result in the card not being used.

- Make your payments on time

Set up automatic payment reminders to ensure that you make payments on time. Remember, your payment history is vital in calculating your credit score.

- Start using the card

Start using your secured credit card once you’ve paid the security deposit. Just remember to use it wisely! Keep your balance low and avoid maxing it out to keep your credit utilization in check and build a strong credit history.

- Move up to an unsecured credit card

Demonstrating responsible credit habits shows you’re ready for an unsecured card. This is your chance to take the next step in your credit journey! While it can vary by issuer, many secured credit cards will automatically transition to traditional unsecured cards once you've built a history of timely payments.

- Keep an eye on your credit score

Regularly monitor your credit score to track progress. Make it a habit to review your credit report to ensure everything is accurate. Mistakes on your credit report could lead to loan denials or higher interest rates. Check your report regularly to spot and address issues early. If you find any errors, reach out to the credit reporting agency to get them fixed right away.

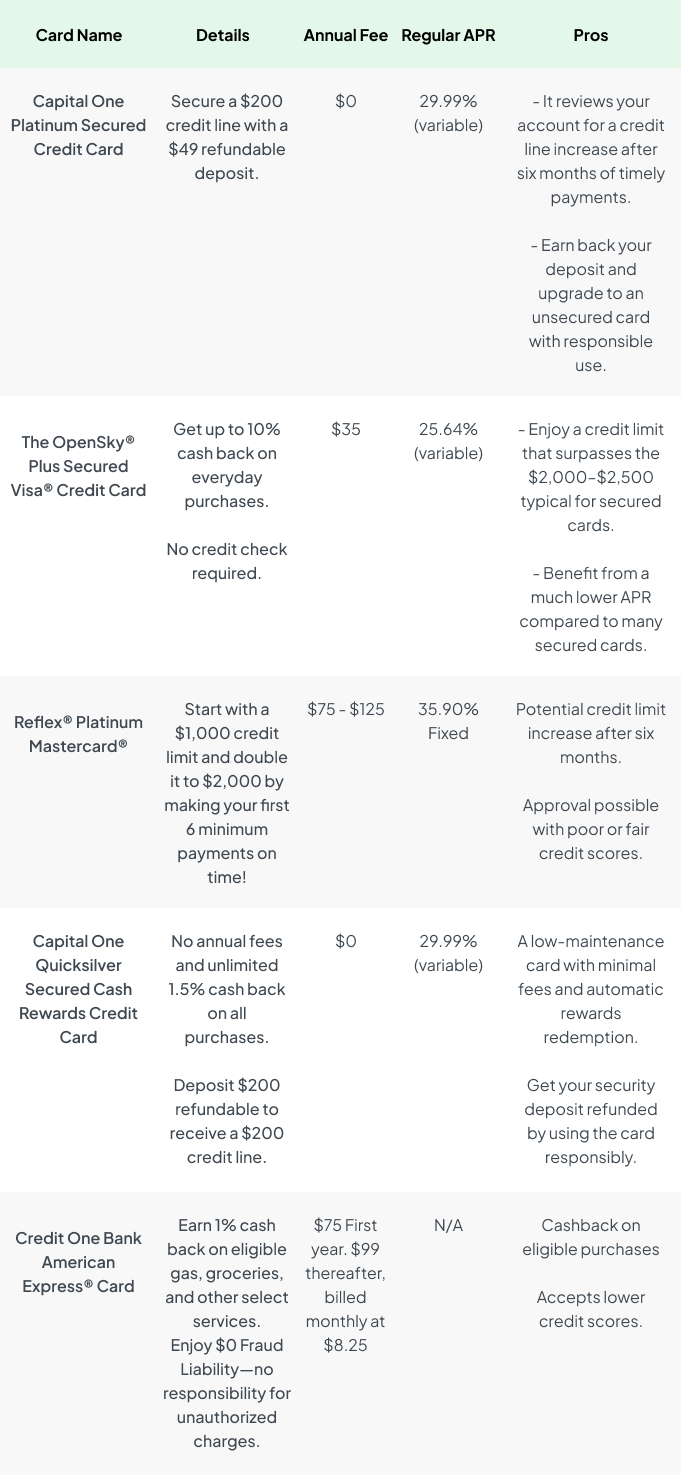

Credit Cards to Help Rebuild Credit

In this section, we'll explore various secured credit cards, highlighting their unique features, benefits, and annual fees. Whether you're new to credit or trying to recover from past mistakes, these options can help you take control of your credit-building efforts and pave the way to better financial health.

From Credit Monitoring to Flexible Credit Booster Payment Plans: How CoolCredit Helps You Succeed

CoolCredit offers a seamless, user-friendly platform to help you track your credit progress and improve your credit score effectively. With CoolCredit, you can easily monitor your credit score and get alerts on changes, allowing you to stay on top of your credit-building journey. CoolCredit’s AI-driven tools assist in identifying negative items on your credit report, providing step-by-step guidance or expert assistance to dispute these items and improve your credit score.

CoolCredit also offers flexible payment plans that allow you to consistently make on-time payments, which are reported to major credit bureaus. This not only helps you build a positive credit history but also accelerates your path to financial freedom. CoolCredit is your partner in navigating the complexities of credit building, ensuring that every step you take brings you closer to your financial goals.

AI Credit Repair at Your Fingertips – Improve Your Score Now!

Get started5 Key Factors to Consider When Choosing a Secured Credit Card

- Credit reporting: Check that the card you pick sends your payment history to the main credit bureaus. This is important for building or improving your credit score, as regular reporting helps you build a good credit history.

- Deposit requirements: Make sure the secured credit card you choose has a deposit amount that fits your budget. This deposit acts as your credit limit, so pick a card where the deposit is affordable for you.

- Affordable fees: Check the card’s fees closely because some secured credit cards charge annual fees, application fees, or other costs. Choose a card with low fees to save money.

- Upgrade option: When picking a secured credit card, see if it offers a way to upgrade to an unsecured card. Some secured cards let you switch to an unsecured card after showing responsible use. This can help you boost your credit score and get better credit offers in the future.

- Flexible payment period: A flexible payment period is the time you have to pay off your balance without paying interest, usually about 21 to 25 days after your billing cycle ends. This grace period helps you pay on time and avoid extra costs, making it easier to manage your payments.

How Secured Credit Cards Compare to Other Credit-Building Tools

When it comes to building or rebuilding credit, secured credit cards and credit-builder loans are two popular options. Both tools can help establish a positive credit history and improve credit scores, but they operate differently and suit different financial needs. The table below compares these two credit-building options, highlighting their features, advantages, drawbacks, and the type of user each is best suited for.

| Feature | Secured Credit Cards | Credit-Builder Loans |

| Overview | Requires an upfront cash deposit that serves as your credit limit. | Make fixed payments; receive the loan amount after it’s paid off. |

| Pros | - Builds credit quickly. - Control overspending. - Widely accepted. | - No upfront cost. - Savings opportunity. - Builds credit. |

| Cons | - Requires upfront deposit. - Possible fees. - Limited rewards. | - Delayed access to funds. - Possible fees. - Requires discipline. |

| Credit Reporting | Yes, payments reported to credit bureaus. | Yes, payments reported to credit bureaus. |

| Cost | Deposit required; possible fees and interest. | Monthly payments with potential fees. |

| Access to Funds | Immediate, within credit limit. | Funds released after loan is fully paid. |

| Best For | Individuals with no credit or poor credit history. | Those who want to build credit and save. |

| Credit Impact | Directly builds credit through responsible card use. | Builds credit through consistent loan payments. |

| Learning Opportunity | Teaches credit management and responsible spending. | Teaches loan repayment and financial discipline. |

Conclude

Secured credit cards can be a smart way to build or rebuild your credit, especially if traditional credit options are out of reach. By picking the right card and using it wisely—making timely payments and keeping your balance low—you’ll set yourself up for a stronger credit profile.

Don’t forget to keep a tab on how you are doing. Tools like CoolCredit can make this easier. With CoolCredit, you can track your credit score, get alerts for changes, and use flexible payment plans to stay on top of your credit-building goals. Their easy-to-use platform and helpful features can guide you through the process and help you manage any issues. With a little patience and the right tools, you’re on your way to achieving better credit and financial health.

FAQs

Q: What Are the Best Secured Credit Cards to Build Credit?

A: If you are looking for credit cards for rebuilding credit, here are your options:

- Capital One Platinum Secured Credit Card

- The OpenSky® Plus Secured Visa® Credit Card

- Reflex® Platinum Mastercard®

These secured credit cards provide various features and benefits to help you rebuild your credit, with options that cater to different financial needs and credit situations.

Q: How Quickly Can a Secured Card Build Credit?

A: Building credit isn’t an overnight process and the speed at which you see results can vary based on your situation. For those new to credit, a secured credit card is an excellent starting point. Generally, you’ll start seeing the effects of your on-time payments on your credit report within two to three months. However, it might take up to six months before you see your first credit score.

Q: Will Applying for a Secured Credit Card Impact My Credit Score?

A: Applying for a secured credit card might lead to a hard inquiry on your credit report, which could cause a slight, temporary dip in your credit score. This is a normal part of the application process, and the impact is usually minor and short-lived. Over time, if you use the card responsibly and make timely payments, you’ll likely see your credit score improve as you build a positive credit history.

Q: What Is the Best Secured Credit Card?

A: The best secured credit card for you will depend on your personal needs and financial goals. When choosing, look for cards that offer reasonable fees, a manageable security deposit, and the opportunity to upgrade to an unsecured card in the future. Also, check if the card reports to major credit bureaus, as this will ensure your positive payment history helps build your credit score. It’s a good idea to compare various options and select a card that fits your budget and credit-building needs.

Q: How Can I Use a Secured Credit Card to Build Credit?

A: A secured credit card can be a powerful tool for building your credit if you use it wisely. Start by making sure you pay your bill on time each month. Your on-time payments will be reported to the credit bureaus and help establish a positive credit history. Keep your balance low and try to avoid maxing out your credit limit. Over time, these responsible habits can lead to an improved credit score.

Q: When Can I Upgrade From a Secured Credit Card to an Unsecured Card?

A: Usually, it takes between 6 to 18 months of responsible use for a secured credit card to become eligible for an upgrade to an unsecured card. However, this timeline can vary depending on your card issuer and how well you manage your account. To find out your specific upgrade eligibility, it's a good idea to reach out to your lender and ask about their policies and requirements.