From 808 Credit Score to 850: Achieving The Perfect Score

Only a quarter (22%) of Americans have a FICO Score of 800 or higher, so if your credit score is 808, you're already doing an 'exceptional' job. It is not only exceptional, but also so close to the perfect score of 850 that there's no reason to not aim for it. But how do you take your 808 credit score to the perfect 850? Let's dive right into it.

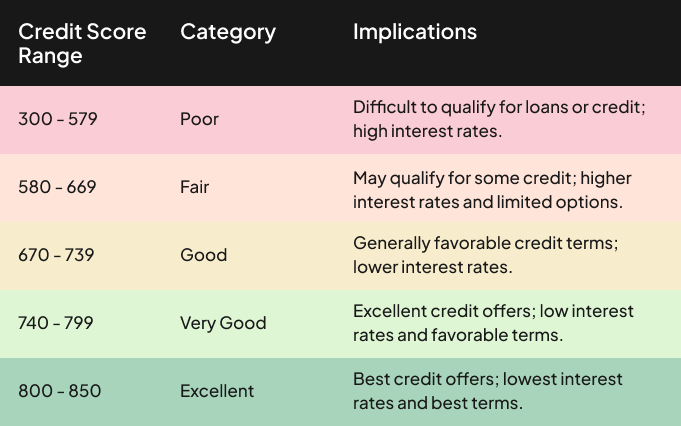

But first, here's a quick recap of all the credit score ranges and what they entail:

Now, before we get into the hows of achieving the perfect score of 850, let’s quickly go over the

Benefits You Have When You Reach The Score 808 In Credit Points

| Financial Product/Opportunity | Eligibility/Benefits |

| Mortgage Loans | Access to the lowest interest rates, favorable terms, and higher loan amounts. |

| Auto Loans | Lowest interest rates, flexible terms, and higher loan amounts. |

| Credit Cards | Eligibility for premium rewards cards, higher credit limits, and lower interest rates. |

| Personal Loans | Access to the best rates, higher loan amounts, and more favorable terms. |

| Refinancing Options | Ability to refinance existing loans at lower rates. |

| Home Equity Loans/Lines of Credit | Higher loan amounts, lower interest rates, and favorable terms. |

| Insurance Premiums | Potentially lower premiums due to high creditworthiness. |

| Rental Applications | Higher likelihood of approval and possibly lower security deposits. |

| Business Loans | Favorable interest rates, higher loan amounts, and better terms. |

| Student Loans (Private) | Access to lower interest rates and favorable repayment terms. |

| Apartment Leases | Greater likelihood of approval and lower security deposits. |

| Utility Deposits | Potentially waived deposits or lower deposit amounts. |

| Cell Phone Contracts | Easier approval and potentially lower security deposits. |

| Travel and Hotel Rewards | Eligibility for premium travel and hotel rewards programs. |

| Retail Financing | Access to low or 0% financing options. |

| Employment Opportunities | Favorable impression for jobs that consider credit scores. |

| Interest Rates on Existing Debt | Potential eligibility for lower interest rates on existing debt through negotiation or refinancing. |

| Exclusive Financial Products | Access to exclusive financial products and services from top-tier financial institutions. |

Take Control of Your Credit with Our AI-Powered App

Try NowExcellent, aren’t they? Just like the range score 808 falls in. Now, the question is, why even bother to aim for a perfect 850 when an 808 credit score already gives you access to all these perks? Let’s get right to it.

Taking Your 808 Credit Score To The Perfect 850: Is It Worth It?

The short answer is yes. And bragging rights aren't the only reason why. Here are 5 reasons to improve your score 808 and aim higher:

- EVEN lower interest rates on loans.

- EVEN higher credit limits available.

- EVEN Easier credit card approvals.

- EVEN lower insurance premiums.

- EVEN better rental application success.

Did we mention bragging rights?

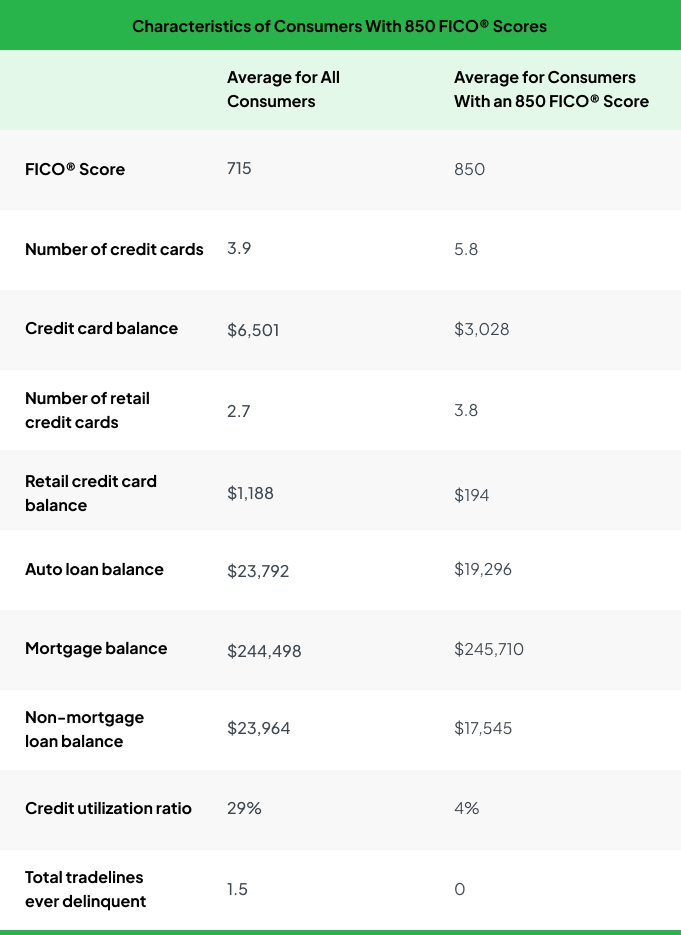

Moreover, according to recent Experian data, only 1.54% of U.S. consumers had a FICO Score of 850. So, it is a matter of great deal. A status symbol even. So, what do those with an 850 credit score do differently? Let’s have a look

How The OGs Do It: Learn From Those Who’ve Already Achieved It

- Those with the perfect credit of 850 often have lower debt balances overall, with many owning mortgages and purchasing more expensive homes due to their excellent credit.

- Such individuals are observed to maintain a near-zero credit utilization rate, keeping balances on multiple credit cards low, which is crucial for a high credit score.

- With an average number of delinquencies at zero, they ensure all their bills are paid on time.

- Many have extensive credit histories, with the majority being baby boomers and Generation X, contributing to their perfect credit scores.

Unlock Better Credit with the Power of AI Credit Repair

Get StartedFrom Score 808 to 850 - How To Reach The Pinnacle Of Credit Excellence

1. Your Credit Utilization Rate Should Be LOW At All Times

Although it is usually suggested to keep your credit utilization rate below 30%, if you want the perfect credit score, aiming for a utilization rate of under 10% is ideal. Additionally, try to pay off your balance in full each month.

2. Hard Inquiries Are A Big NO

Refrain from applying for new loans or credit accounts, especially in a short span of time. Each hard inquiry can impact your 808 credit score. So, instead of reaching the perfect 850, you might end up with a lower than 808 score.

3. Keep A Close Eye On Your Credit Report

Maintaining your 808 credit score is the first step, and building the perfect credit is the next. Monitor your credit closely to stay on track. CoolCredit offers comprehensive credit monitoring with alerts and insights. The AI-assisted credit repair app tracks, reviews, and analyzes your credit report, keeping you informed and equipped to make smart financial decisions.

4. Your Credit Report Should Be 100% Error-Free

Nothing can keep you from achieving the perfect credit score when you have a score 808 like an error in your report. And that is why identifying and disputing them is so crucial. So, be surely to proactively monitor your credit reports for such inaccuracies and dispute them promptly.

| Easily dispute inaccuracies with CoolCredit ▪ Click On The Create Dispute Button: CoolCredit will analyze negative items in your report and create a repair plan. ▪ View Negative Items: Get a comprehensive view of all negative items, including high-impact accounts and collections. ▪ Fix Errors: Click 'Fix Error' for each negative item to continue. ▪ Choose Your Path: Expert Assist: An experienced professional guides your repair process. DIY Approach: Manage disputes independently with a 10-step guide. |

5. Leave Those Credit Lines Open

The length of your credit history contributes to your score. So, avoid closing old credit accounts, as they can positively impact your score by increasing the average age of your accounts.

6. Stating The Obvious - Pay Every Bill On Time

This cannot be stressed enough—always pay your bills on time. Late payments can significantly affect your credit score. And with an 808 credit score, you surely know how. Set up automatic payments or reminders to ensure you never miss a due date.

7. Get Credit Educated

If you want to take your score 808 to the perfect 850, you need to know the ins and outs of credit building by heart. Even a single misstep can cost you significant credit points. That's why gaining credit education should be on your cards. CoolCredit offers credit education courses to help you acquire all the knowledge you need to build credit.

Conclusion

While an 808 credit score is already excellent, aiming for the perfect 850 can offer even more financial advantages—not to mention the bragging rights. By keeping a low credit utilization rate, avoiding hard inquiries, and ensuring your credit report is error-free, you can get closer to that perfect score. Tools like CoolCredit can help you stay on track and manage your credit effectively.

FAQs

Q: Is 808 a good credit score?

A: If you're wondering 'Is 808 a good credit score?', the answer is yes. In fact, it is excellent. It indicates strong creditworthiness, often qualifying you for the best loan rates and credit offers.

Q: Is there a big difference between 800 and 850 credit score?

A: Not significantly; both scores are considered excellent, but 850 is the highest possible score and reflects perfect credit management. And accordingly, it has its own perks.

Q: How to get credit score from 800 to 850?

A: To improve from 800 to 850, ensure low credit utilization, timely payments, and maintain a long history of positive credit behavior without taking on unnecessary debt.

Q: Does anyone ever reach 850 credit score?

A: Yes, according to recent Experian data, 1.54% of U.S. consumers have a FICO Score of 850. So, it's not entirely impossible.