808 Credit Score: What It Means and How to Maximize Its Benefits

808 credit score is considered Exceptional.

Falling within the 800-850 range, an exceptional score means you're in a prime position to secure the best interest rates and offers on everything from auto loans to mortgages. Lenders see you as a low-risk borrower, giving you access to top-tier deals and financial perks.

A credit score of 808 also implies that you are a responsible individual who uses the credit responsibly, you pay bills on time and your credit report doesn't show any collections.

| What You Should Know About an 808 Credit Score With an 808 credit score, you can access all borrowing options with some of the best terms. This means qualifying for top-tier credit cards and personal loans with ease. Want to bump up your score even more? Try lowering your credit card balances. For personalized tips, check out CoolCredit. |

Is 808 a Good Credit Score? What Can I Get With an 808 Credit Score?

An 808 credit score is excellent and puts you in the "exceptional" category. With a score this high, lenders see you as a very low-risk borrower, giving you access to many great opportunities.

Let Our AI Credit Repair Analyze Your Report And Fix Issues For A Better Score.

Start todayHere's what you can expect with an 808 credit score:

1. 808 Credit Score Mortgage Loan Options

According to TheMortgageReports, individuals with a FICO score between 760-850, get 6.976% mortgage APR.

| FICO Score | Mortgage APR* |

| 760-850 | 6.976% |

| 700-759 | 7.198% |

| 680-699 | 7.375% |

| 660-679 | 7.589% |

| 640-659 | 8.019% |

| 620-639 | 8.565% |

A credit score of 808 is considered excellent, positioning you among the top tier of borrowers. This score reflects your strong creditworthiness and opens doors to the most favorable mortgage loan options.

To put things in perspective, a credit score of 620 is often seen as the minimum threshold for qualifying for a conventional mortgage loan. While it's possible to secure a mortgage with a 620 score, the terms and interest rates won't be as favorable. Lenders view borrowers with a 620 score as high risk, which typically results in higher interest rates and possibly stricter loan terms.

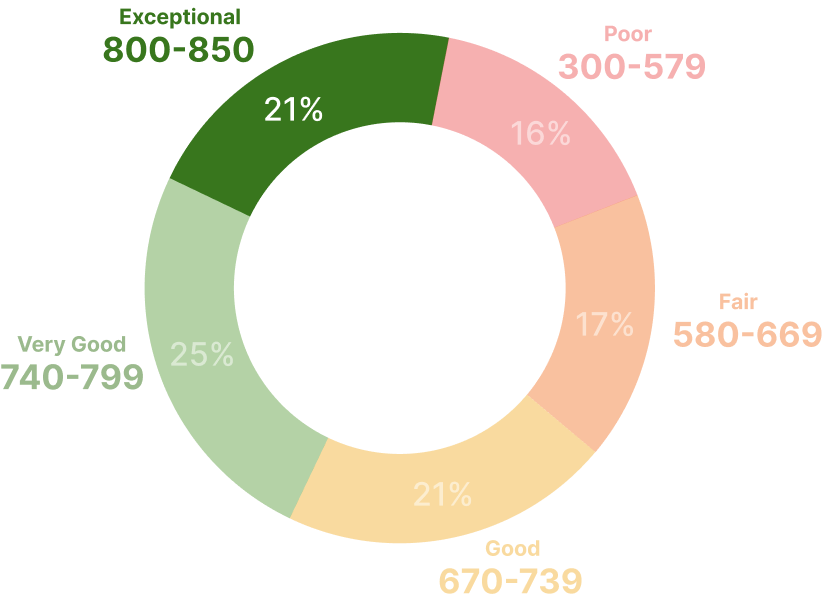

| Are You Among the Americans With an Exceptional Credit Score? Experian reports that nearly 22% of Americans have a FICO Score of 800 or higher, a level the credit scoring company calls exceptional. |

With an 808 credit score, you stand to benefit from significantly lower interest rates. Lenders are more confident in your ability to manage debt responsibly, making you eligible for the best mortgage offers. Lower interest rates translate to lower monthly payments and less money paid over the life of the loan, providing substantial long-term savings.

| Why an 808 Credit Score Matters for Your Mortgage Access to Competitive Rates: Ensures you receive the most competitive mortgage rates. Affordability: Lowers the overall cost of homeownership. Financial Advantage: Makes buying a home more financially beneficial. |

2. 808 Credit Score Car Loan Options

If you’re planning to buy a car with an 808 credit score, you’re in a great spot. This exceptional score offers a variety of perks that can make your car purchase easier, more affordable, and more flexible.

With an 808 credit score, lenders view you as a low-risk borrower, which qualifies you for the lowest interest rates on auto loans, leading to smaller monthly payments and less interest over time. Additionally, your score opens the door to a variety of financing options, including longer repayment periods and larger loan amounts, allowing you to choose a plan that aligns with your budget and financial goals. You may even have the opportunity to finance the entire cost of the car with little or no down payment, as lenders are confident in your ability to repay the loan. This strong credit score also gives you greater leverage in negotiations, enabling you to secure better terms, discounts, and incentives. Moreover, the car-buying process could be faster, with quicker loan approvals, getting you behind the wheel sooner.

| Purchasing a Car With an 808 Credit Score Top-Tier Interest Rates: Qualify for the lowest auto loan rates, reducing monthly payments and overall interest. Easy Financing: Enjoy a wide range of loan terms and larger loan amounts, tailored to your needs. No Down Payment Options: Your high score may allow you to finance the full cost of the car. Negotiation Leverage: Leverage your excellent credit for better deals, discounts, and incentives. Quick Approval: Benefit from a faster and smoother loan approval process, getting you on the road sooner. |

3. 808 Credit Score Credit Card Options

Most credit card companies don’t usually set a clear minimum credit score requirement and those that do often keep it under wraps. However, with an excellent score like 808, you’re likely to be eligible for nearly any credit card on the market. Of course, other factors come into play too—like how many cards you’ve applied for recently. Even with a great score, too many recent applications might slow you down.

For personal loans, you don’t need to have an 808 credit score, but it gives you an edge. A score that high can help you land the best interest rates and reduce loan origination fees, making your loan much easier on your wallet.

With an 808 credit score, you might be eligible for premium credit cards with higher rewards, benefits, and perks.

| Getting a Credit Card With an 808 Credit Score Eligibility: With an 808 credit score, you're likely eligible for almost any credit card available. Issuer Criteria: Approval also depends on factors like recent credit card applications, not just your credit score. Personal Loans: An 808 credit score isn't necessary for personal loans, but it can secure better interest rates and lower fees. Financial Advantage: A high credit score like 808 can make loans more affordable overall. |

▪ Better Insurance Rates

A credit score of 808 can help lower your insurance premiums. Insurance companies often use credit scores to figure out how risky a customer might be. Since people with high credit scores are seen as more financially responsible, they usually get lower rates. With an 808 credit score, you might not only get better rates but also be eligible for discounts, saving you money. Plus, you might have more room to negotiate with your insurer for even better deals.

▪ Easier Approval for Rental Applications

When you're looking to rent a home or apartment, an 808 credit score gives you a big advantage. Landlords use credit scores to judge if you'll be a reliable tenant. A high score shows you're good with money and likely to pay your rent on time, which makes you a stronger candidate. This could mean you get approved faster and might even be able to lower or skip the security deposit. In a competitive rental market, having a top-notch credit score can also help you snag better lease terms and conditions.

How To Improve 808 Credit Score?

Keeping an excellent credit score like 808 in top shape requires ongoing good habits and a bit of fine-tuning. Here’s how you can keep your score shining or even make it a bit better:

▪ Keep Your Credit Card Balances Low: Aim to use less than 30% of your total credit limit. This helps you stay on top of your game.

▪ Pay Your Bills Promptly: Timely payments on your credit cards, loans, and other bills are essential for a stellar score.

▪ Check Your Credit Reports Regularly: Review your credit reports for any mistakes or inaccuracies and get them corrected.

▪ Diversify Credit Types: Having a variety of credit types, like credit cards and loans, can boost your score.

▪ Hold on to Your Old Accounts: The longer your credit history, the better. Keep old accounts open even if you don’t use them often.

▪ Limit New Credit Applications: Too many credit inquiries can hurt your score. Be selective about new credit applications.

Boost Your Credit Score Fast With CoolCredit

Want to improve your credit score quickly? CoolCredit can help you see real results in just 30 to 60 days. Unlock better financial opportunities with our proven methods and personalized strategies. Don’t let a low credit score hold you back—team up with CoolCredit and take charge of your financial future.

With Our Credit Repair App, Monitor & Improve Your Credit Score Easily

Get StartedHow Does an 808 Credit Score Compare to an Average Credit Score?

The following table highlights key differences in benefits and challenges. It clarifies what an exceptional credit score can mean for your financial opportunities and how it stacks up against the average.

| Aspect | 808 Credit Score | Average Credit Score (718) |

| Interest Rates | Lowest rates available, saving money over time | Higher rates compared to exceptional scores |

| Loan Terms | Favorable terms with flexibility | Standard terms, may not be as flexible |

| Credit Card Limits | Higher limits and better rewards | Standard limits and rewards |

| Approval Likelihood | High likelihood of approval for loans and credit cards | Moderate likelihood of approval |

| Impact of Inquiries | Minor impact from new inquiries | Higher impact from new inquiries |

| Monitor and Manage Your Exceptional Credit Score With CoolCredit's AI-Powered Credit Repair App ▪ Dedicated Expert Support With CoolCredit, you’ll have a dedicated partner guiding you through every stage of your credit journey—from building and improving your credit score to repairing any issues. ▪ Dispute Letter Templates CoolCredit offers ready-made dispute letters, making it easy to address and fix any mistakes on your credit report. ▪ Thorough Credit Monitoring CoolCredit meticulously tracks, reviews, and analyzes every aspect of your credit report, keeping you informed and in control of your credit health. ▪ Smooth Start with Our Credit Repair App The CoolCredit app provides an easy and seamless start to your credit-building journey, offering all the tools you need to boost your score effectively. ▪ Comprehensive Credit Insights Gain clear and detailed insights into your credit report with CoolCredit. We highlight key areas for improvement and provide actionable steps to enhance your credit. ▪ Intuitive and User-Friendly Interface Navigate your credit journey effortlessly with our user-friendly app, for a smooth and efficient experience. ▪ Top-Level Security and Confidentiality We prioritize your privacy, using the strictest security protocols to ensure your credit repair process is secure and confidential. |

Protect Your Exceptional Credit Score from Identity Theft and Fraud

If you're a victim of identity theft, your credit score could drop. Thieves might open credit accounts in your name and not pay the bills, causing debt to add up. This can hurt your score since payment history and credit utilization are key factors in determining it.

To undo the damage caused by theft, you can team up with banks and collection agencies to clear fake accounts, late payments, or debts from your credit report. You can also dispute these issues with the three main credit bureaus to correct your credit. Here are some tips to repair your credit after identity theft:

Freeze your credit with Experian, TransUnion, and Equifax to prevent further fraud.

- Change your passwords to stronger ones.

- Let your bank and lenders know about the fraud.

- Report the theft or file a police report.

- Sign up for credit monitoring to receive notifications about any suspicious activity.

Conclusion

Having an 808 credit score is a remarkable achievement that paves the way for the best financial perks, like the lowest loan interest rates, premium credit cards, and excellent mortgage options. To keep enjoying these advantages, it's crucial to manage your credit carefully. That’s where CoolCredit- ai credit repair comes in—it offers the tools and guidance you need to monitor and boost your credit score, helping you stay ahead in your financial journey.

FAQs

Q: How Does an 808 Score Stack up Against the Average Score?

A: As compared to the average credit score, an 808 score is an excellent credit category to be in. As per FICO, the average credit score is 718. Therefore, the 808 credit score is far better than having an average score.

Q: Can Changes in My Credit Report Impact My 808 Score?

A: Yes, variations in your credit report, such as new credit queries, late payments, or shifts in your credit utilization, can impact your 808 credit score.

Q: How Can I Leverage My 808 Credit Score for Better Loan and Credit Card Terms?

A: With an 808 credit score, you’re in a great spot to get better deals on loans and credit cards. You can also call lenders or credit card companies and ask for lower interest rates or higher credit limits, using your strong credit history as a reason.

Q: How Often Should I Check My Credit Report With CoolCredit?

A: It's a good practice to check your credit report regularly, at least once a month, to ensure accuracy and spot any potential issues early.

Q: Can I Use CoolCredit if I Already Have a Good Credit Score of 808?

A: Absolutely! CoolCredit is beneficial for anyone wanting to monitor and maintain their credit score, whether it's already excellent or needs improvement.

Q: Is CoolCredit Secure?

A: Yes, CoolCredit employs advanced security measures to protect your personal and financial information. Your data is encrypted and handled with the highest standards of privacy and security.

Q: How Good Is an 808 Credit Score?

A: An 808 credit score is considered outstanding, falling within the exceptional range of 800-850. This level of credit score indicates that you have a stellar credit history and are highly likely to be approved for new credit at the best terms.

Q: How Rare Is an 800 Credit Score?

A: An 800 credit score is quite rare and signifies an exceptional level of creditworthiness. Experian reports nearly 22% of Americans have a FICO Score of 800 or higher, as it requires consistently excellent credit habits.