750 Credit Score: Is It Good Enough and How To Improve It?

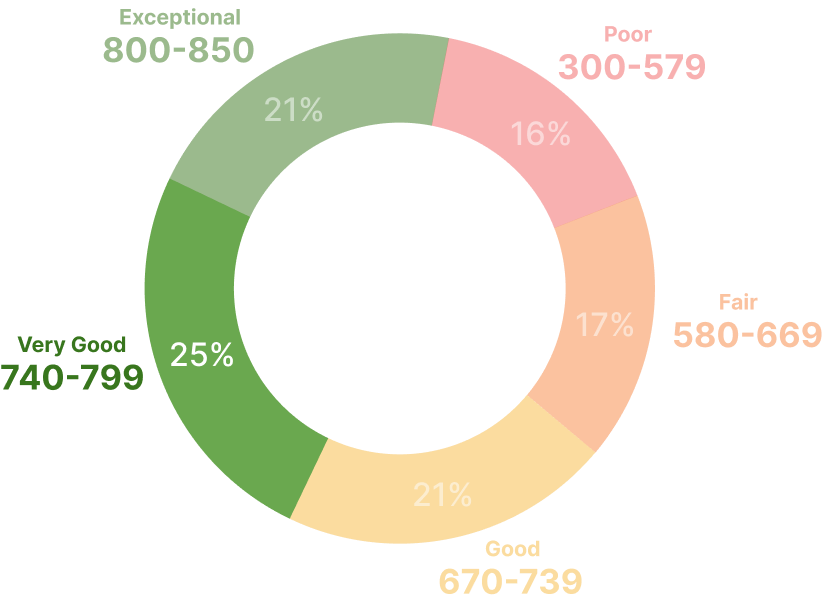

According to FICO, 47% of Americans have a 750 credit score.

Is 750 a good credit score? Absolutely yes! Moreover, FICO and VantageScore agree that 750 is not just good; it's excellent!

With this credit score, lenders see you as a safe bet. Indeed, it's a sign that you've managed your credit responsibly and are likely to keep doing so. Having a credit score in this range means you can get approved for loans and the lowest mortgage rates. Additionally, a credit score of 750 can boost your chances of getting approved for rentals, utility services, and even job opportunities, since some employers review credit during hiring.

What Does 750 Credit Score Help You Get?

Wondering what happens with a 750 credit score? The truth is, you get everything better!

Better Borrowing Terms

You can get a loan of $50,000 to $100,000 at lower interest rates. Moreover, you get insurance without any hassle. Not only this, but also if you have pending balances on other credit cards, you can negotiate them with the lender and lower them down.

Better Car Loans

If your question is, “Can I buy a car with a 750 credit score?”, the answer is a resounding yes!

A credit score of 661 or higher is usually required for an auto loan. With a credit score of 750, you're definitely in a strong position.

Car loan rates by FICO Score:

| FICO Score | Average rate for new cars | Average rate for used cars |

| 781 - 850 (super prime) | 5.38% | 6.80% |

| 661 - 780 (prime) | 6.89% | 9.04% |

| 601 - 660 (near prime) | 9.62% | 13.72% |

| 501 - 600 (subprime) | 12.85% | 18.97% |

| 300 - 500 (deep subprime) | 15.62% | 21.57% |

Better Housing Loans

The interest rate you receive for buying a house is directly related to your credit score. A 750 credit score positions you to receive attractive rates from lenders, assuming you fulfill other criteria.

Housing loan rates by FICO Score:

| FICO Score | Interest Rates |

| 760 - 850 | 6.5% |

| 700 - 759 | 6.72% |

| 680 - 699 | 6.9% |

| 660 - 679 | 7.11% |

| 640 - 659 | 7.54% |

| 620 - 639 | 8.09% |

Elevate Your Credit Score with AI Precision

Get StartedHow To Attain A 750 Credit Score

Building your credit score might take some time, but the financial savings you'll enjoy in the future will make it all worthwhile.

The approaches to achieving that excellent 750 score are mentioned below:

The 7 golden steps!

- Always prioritize timely payments.

- Review your credit reports for your current standing.

- Reduce your credit card balance.

- Build a mix of credit types.

- Avoid opening too many accounts.

- Maintain a long history of positive credit behaviors.

- Stay disciplined in your financial habits.

Improve Your Credit Score Beyond 750 with These Tips

Learn the elements that shape your credit score and tips to achieve higher scores.

| Factors | Contribution to Credit Score | Tips to Improve |

| Timely payments | 35% | Use automatic payments or alerts to make sure you never miss a due date. |

| Low credit score balance | 30% | To optimize your score, try to maintain your credit usage under 30%, and ideally under 10%. |

| Old credit accounts | 15% | Keep your old accounts active to preserve your long credit history. |

| Credit mix | 10% | Avoid opening new accounts just to diversify; instead, responsibly manage different types of credit. |

| Hard enquiries | 10% | Apply for new credit only when necessary, and try to keep multiple inquiries within a short period. |

Other factors are as follows:

Credit Reports

Tip to improve: Get a free annual credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion)

Credit Cards

Tip to improve: When using credit cards, opt for smaller, manageable purchases and always pay off the balance in full each month to avoid accruing interest.

Change in Credit Score

Tip to improve: Use credit monitoring services to receive alerts about changes to your credit report and score.

Credit Repair Made Simple – AI-Powered Solutions at Your Fingertips

Get StartedWays to Safeguard Your 750 Credit Score

Watch over your FICO and VantageScore quickly by following these steps:

▪ Keep a Check on Your Credit Reports

Keeping an eye on your credit reports is key to staying on top of your financial game. Your credit report is like a detailed record of your credit life, showing all your accounts, payment history, and any inquiries made into your credit. So, it is evident to check your credit regularly. Positively, it ensures your credit history is correct and your financial health stays on track.

▪ Enhance Your Credit Diversity

Credit mix refers to having varied credit accounts, such as credit cards, loans, or a mortgage. When lenders see you handling all of them effectively, it reflects that you can manage diverse financial obligations. As a result, it helps sustain your 750 score and possibly improves it.

▪ Improve Your Credit Utilization Ratio

Your credit utilization ratio is basically how much of your available credit you're using. To keep things in the sweet spot, aim to use less than 30% of your total credit limit at any given time. Most importantly, tackle those high balances charging you the most interest. You could also think about asking your credit card company to increase your credit limit. However, it is recommended to use your credit card limit wisely.

▪ Obtain a Secured Credit Card

Secured cards operate differently from traditional credit cards. You start with a cash deposit, which sets your credit limit. Then you can use this deposit to cover your losses. The key to making it work for you is to use it responsibly: pay off your balance promptly and aim to keep your spending in check.

Conclusion

A 750 credit score? That's the ticket to the best deals and lowest rates. But let's be real, not everyone can get there, and keeping your credit score on an upward trajectory takes a lot of hard work. However, if you're not into all the nitty-gritty like optimizing your credit ratios or credit mix, you can use AI credit repair tool-CoolCredit. It makes credit repair a breeze.

FAQs

Q: Is 750 a Good Credit Score to Buy a Car?

A: A credit score of 750 is generally considered excellent for buying a car. It positions you well to secure favorable interest rates on your car loan, as lenders view this score as an indicator of low risk. This means you are likely to be offered lower interest rates, which can significantly reduce the total cost of the loan.

Q: What Can You Get With a 750 Credit Score?

A: A 750 credit score means you'll likely get better interest rates and loan terms, saving you a lot of money over time. It also enhances your chances of getting approved for rentals, utility services, and even some jobs, as employers sometimes look at credit scores.

Q: How Can I Raise My Credit Score in 30 Days?

A: Raising your credit score in 30 days is challenging but achievable with focused effort. By taking these steps, you can see a positive change in your credit score within a month.

- Start by obtaining a copy of your credit report and checking for any errors or inaccuracies; disputing these can quickly improve your score if resolved.

- Next, focus on paying down credit card balances, particularly if you are close to your credit limit, as high credit utilization can negatively impact your score. If possible, make multiple payments throughout the month to keep your balance low.

- Avoid making any late payments, as payment history significantly influences your credit score.

- Additionally, refrain from applying for new credit, as hard inquiries can temporarily lower your score.

- Lastly, consider asking for a credit limit increase from your credit card issuers, which can help reduce your credit utilization ratio.