720 Credit Score: Is It Good Enough and How To Improve It?

Key Takeaways:

▪ Having a score of 720 is considered good.

▪ A 720 credit score equates to access to more opportunities like personal loans, auto loans, and credit card approvals.

▪ More than 10k+ individuals use CoolCredit to monitor their credit scores for FREE.

What Does a 720 Credit Score Indicate?

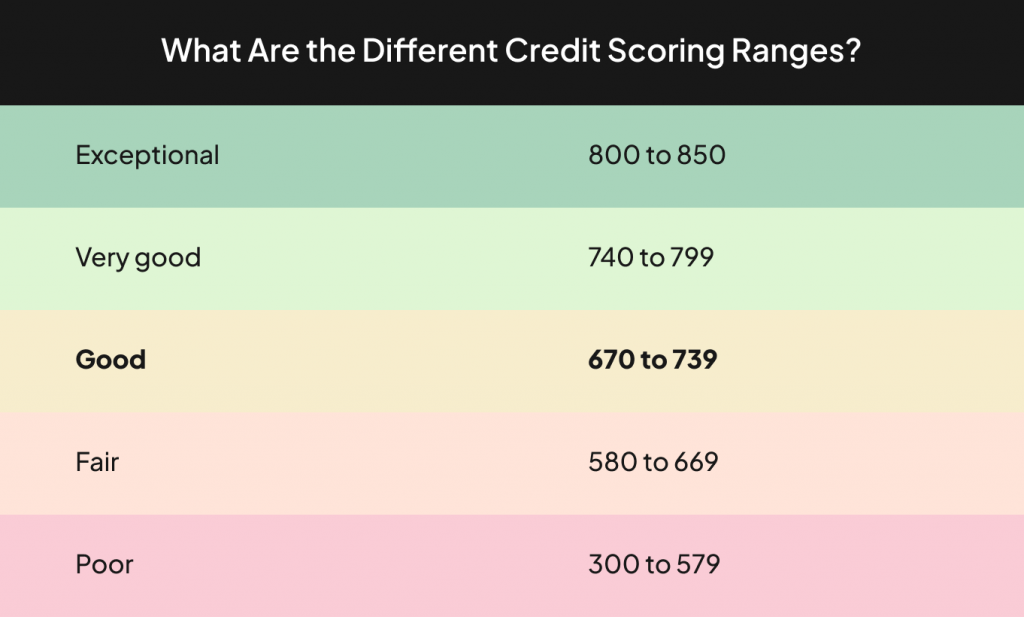

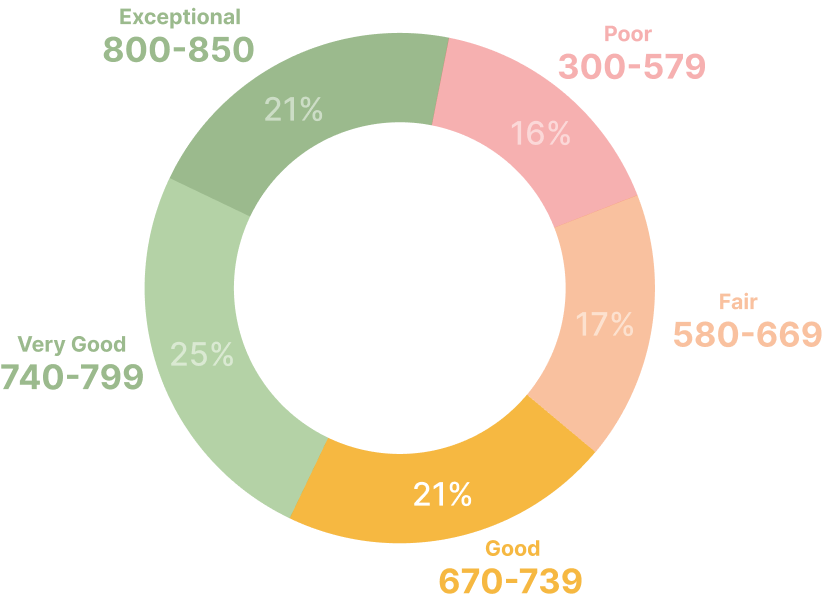

A 720 credit score is a great sign! According to Experian, it falls within the "good" credit range (typically 670-739), which means a significant portion - nearly 22% of U.S. consumers share this score. But what does it mean for you? This score indicates that lenders see you as reliable and a strong candidate for credit and are likely willing to lend to you.

Is 720 a Good Credit Score?

Yes, it is, it increases your chances of owning credit cards and getting approved for various loans. A 720 credit score is a positive indicator! It shows that lenders consider you dependable and likely to repay your loans promptly.

What Can I Get With a 720 Credit Score?

With a 720 credit score, you're likely to get approved for loans more easily than someone with a lower score. However, lenders have different requirements, so it’s important to check if you qualify for what you’re applying for. Also, compare your options to find the best deal. A 720 score is good enough for many loans, including:

◾ Credit Cards

You can choose from different credit cards if you have a 720 credit score. These cards often have great perks like lower interest rates, higher credit limits, and rewarding benefits.

◾ Car Loans

With a 720 credit score, you can easily get a car loan because lenders see you as trustworthy. However, your interest rate might be a bit higher compared to those with superprime scores (781 and above).

Elevate Your Credit with Our AI Technology— Start Your Path to Better Scores

Learn How◾ Mortgages

A 720 credit score is good for getting a mortgage. You can get decent interest rates and good loan terms. Lenders see you as dependable and likely to pay on time, making it easier to get home financing.

◾ Personal Loans

If you have a 720 credit score, you can get personal loans at low interest rates. This helps you pay off debt and handle large expenses.

How To Improve A 720 Credit Score?

With a 720 score, you're already in a good place. To push it to even greater heights, let's explore how you can elevate it further. Here are some smart strategies if you aim to take your score a notch higher:

| Highlights: ▪ Keep your credit utilization under control. ▪ Pay bills on time to avoid penalties. ▪ Maintain older credit accounts for better history. ▪ Apply for new credit only when necessary. ▪ Monitor credit scores regularly for unexpected changes. |

1. Manage Your Credit Usage Wisely:

Aim to use less than 30% of your available credit limit. By doing so, you show you're responsible and not relying heavily on credit.

2. Pay Your Bills On time - Every Time

This is the most important factor for a good credit score. Therefore, even one late payment can hurt your score. To avoid this, set up reminders or automatic payments if needed.

3. Let Your Credit Accounts Age

The longer you've had credit accounts open and managed responsibly, the better your score. This shows a long history of handling credit well.

4. Apply For New Credit Carefully

Only apply for new credit cards or loans when you truly need them. Each time you apply, it can slightly lower your score.

5. Credit Score Monitoring

Tracking your credit score regularly can be a great way to stay motivated on your journey to a better score. Monitoring your score can also alert you to sudden changes as someone might be messing with your credit accounts without your permission.

| CoolCredit is an AI-powered credit repair app that helps with: AI-Powered Credit Analysis: CoolCredit uses artificial intelligence to take a deep dive into your credit report. It can uncover errors, missed opportunities, and areas for improvement you might miss on your own. Real-time Credit Monitoring: CoolCredit provides real-time monitoring of your credit score and report. This allows you to react quickly to any potential issues, like suspicious activity or sudden changes, and address them before they impact your score significantly. DIY Repair: With its user-friendly interface and easy-to-follow guidance, you can dispute errors and inaccuracies on your credit report. CoolCredit provides the tools and resources you need to tackle credit repair tasks independently. Expert Assistance: It gives you an expert review of your credit report, spotting errors and suggesting ways to improve your credit score. Dispute Letter Templates: With CoolCredit’s AI-generated templates, you automatically get dispute letters and you can utilize them to address mistakes on your credit report with minimum effort. |

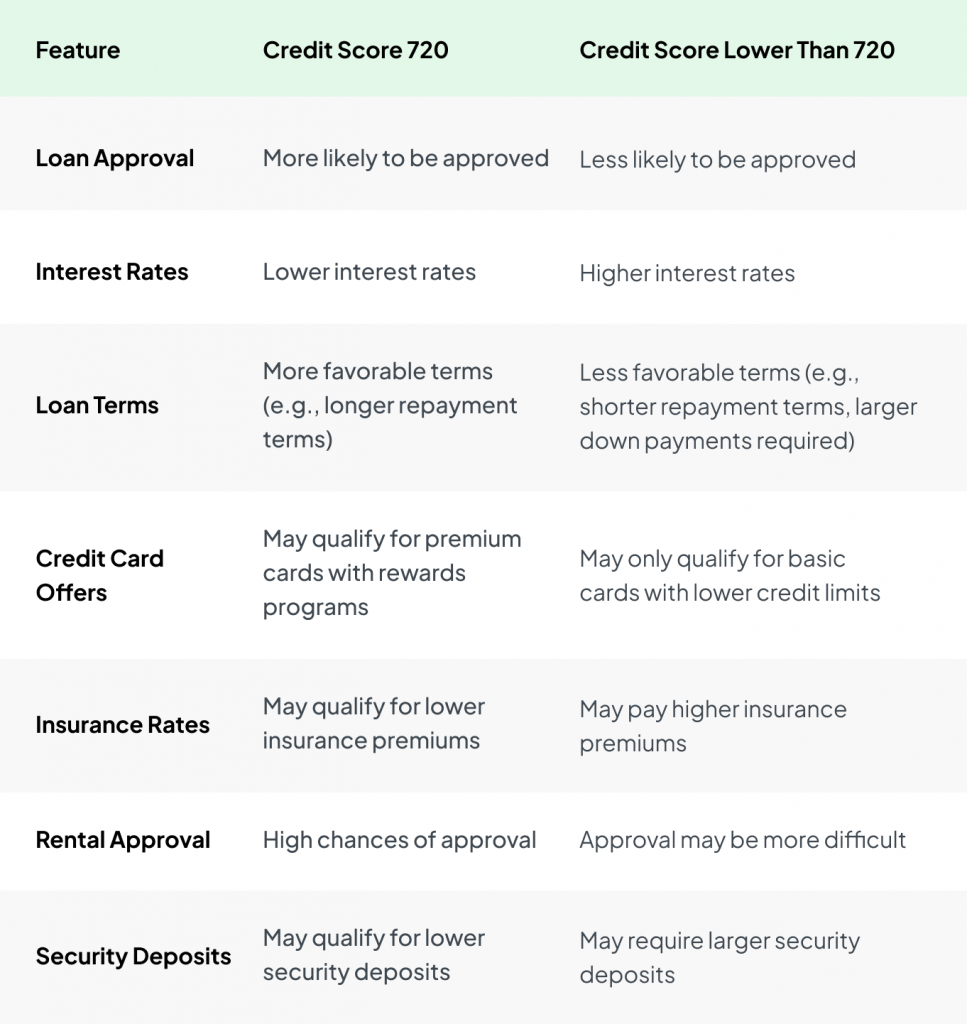

Credit Score Comparison: 720 vs. Lower Than 720

Ever wonder why keeping a good credit score is crucial? It's like a magic key that unlocks better deals on loans, apartments, and even insurance! Here's a quick comparison of what a score of 720 can do for you compared to a lower score.

Conclusion

In summary, having a 720 credit score means you can get loans with better terms and lower interest rates and it shows lenders you're reliable, making it easier to borrow money and rent homes. By paying bills on time, keeping credit card balances low, and checking your credit report regularly, you can maintain and improve your score. This helps you continue enjoying financial benefits and opportunities in the future.

FAQs

Q: Why Is a Good Credit Score Important?

A: A good credit score is like a key to many financial benefits. It can get you lower interest rates on loans and credit cards, make it easier to get a mortgage or car loan, and even lower your insurance costs. Plus, if you're renting, a good credit score can help you get approved by landlords who check your credit scores.

Q: Can I Get My Credit Scores From All the Major Credit Bureaus?

A: Yes, you can. You can access your credit score from one of the major credit bureaus for free with CoolCredit.

Q: With a 720 Credit Score, Can I Get a Personal Loan?

A: A 720 credit score is great for getting a personal loan. Here's why:

- Thumbs Up from Lenders: Lenders generally consider a score between 670 and 739 good, and 720 fits right into that range.

- Higher Chance of Approval: With a good score, you're much more likely to get approved for a loan than someone with a lower score.

- Better Loan Deals: A good credit score can mean you get a better deal on your loan, like a lower interest rate (which means you pay less money overall) and possibly even more money borrowed.

Q: What About Auto Loan? Can I Get it With a 720 Credit Score?

A: A 720 credit score is a great advantage when getting a car loan! It falls within the "good" range for lenders (usually 670-739), so you're likely to qualify for a lower interest rate, saving you money overall. Additionally, the rate also depends on the loan term (shorter is cheaper), your down payment (more upfront means potentially lower rates), your income compared to your debts (less debt is better), and even the lender's policies.

Q: What Are the Benefits of a 720 Credit Score?

A: Here's what you can enjoy:

- Huge savings: You'll likely qualify for lower interest rates on loans, which means you keep more money in your pocket!

- Easy approval: A good credit score makes you more likely to get approved for loans and credit cards you apply for.

- Better credit cards: With a good score, you might get premium credit cards with rewards programs and other cool benefits.

- Potentially minor deposits: Some landlords might require less money upfront (security deposit) if you have a good credit score.

Q: How Do I Keep My 720 Score Strong?

A: Here are some simple things to remember:

- On-time payments: This is the BIGGEST factor! Late payments can hurt your score.

- Don't max out your credit cards: Ideally, keep your credit card balances below 30% of the limit.

- Say NO to multiple credits at once: Applying for lots of loans or cards can lower your score temporarily.

- Check your credit report regularly: Make sure there are no mistakes and dispute any errors you find.

Q: My Credit Score Is Less Than 720. Can I Still Get Good Loans?

A: It depends on the lender and loan type. While 720 offers many benefits, you might still qualify for some loans with a lower score. The interest rates, however, might be higher. Consider improving your credit score for even better deals in the future!