What are the Different Credit Score Ranges?

New research suggests that one in ten Americans has no idea what their credit score is, and one in five wouldn't know how to check it. This is not good news. Especially given the importance credit scores hold in the United States. So, it's only wise to be wary of where you are on the credit score chart. And understand how you can improve it.

In this blog, we'll explore credit score ratings, including what are credit score ranges, and types of credit scores. Further, we'll discuss factors influencing the range of credit scores and how you can elevate them all by yourself.

Fix Your Credit Fast! Download Our Credit Repair App Now and Start Boosting Your Score Instantly.

Fix Your CreditWhat Is Credit Score?

A credit score represents an individual's creditworthiness or borrowing power numerically. Lenders use it to assess the risk of extending credit to an individual. They generally associate a lower credit risk with a higher credit score. Moreover, it eases the qualification for loans, provides access to better interest rates, and offers more favorable financial terms. On the other hand, an extremely low credit score can cause creditors to decide against lending you money, leasing you an apartment, or even issuing you phone or cable equipment. Yes, you read that right. And although lenders weigh other aspects such as employment history and proof of income, credit score remains indispensable.

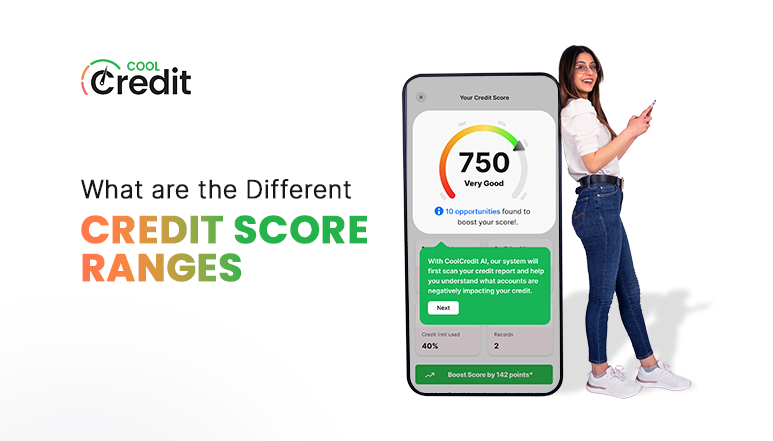

What Are Credit Score Ranges?

Depending on the scoring model used, credit scores may vary. However, the credit score ranges typically falls between 300 and 850. And the higher the score, the better creditworthiness you possess.

Range of Credit Scores, Explained

800-850: Excellent

A credit score range of 800 to 850 is considered exceptional, and lenders deem those within this range as low-risk borrowers. They are highly likely to secure loans easily, often with favorable terms and interest rates.

Reach Excellent Credit Score! Unlock Elite Financial Opportunities

Learn More740-799: Very Good

On the credit score chart, a range between 740 to 799 indicates a positive credit history. It is considered very good and demonstrates a strong track record, making it easier for individuals to get approved for additional credit.

670-739: Good

Credit scores in the range of 670 to 739 still reflect responsible credit behavior. Borrowers in this category are generally regarded as acceptable. However, they may encounter challenges in securing larger amounts of credit or may incur slightly higher interest rates on loans.

580-669: Fair

Lenders often label individuals with credit scores between 580 and 669 as "subprime" borrowers. Lenders may view them as higher-risk applicants. Consequently, they might face difficulties when applying for new credit.

300-579: Poor

A credit score of 300 to 579 is considered extremely low on the credit score graph. Typically, this range of credit scores falls into the poor category. Individuals in this category must take crucial steps to rebuild credit score and secure new credit opportunities.

Transform Your Credit with AI Credit Repair! Get Smarter, Faster Results Using Advanced AI Solutions.

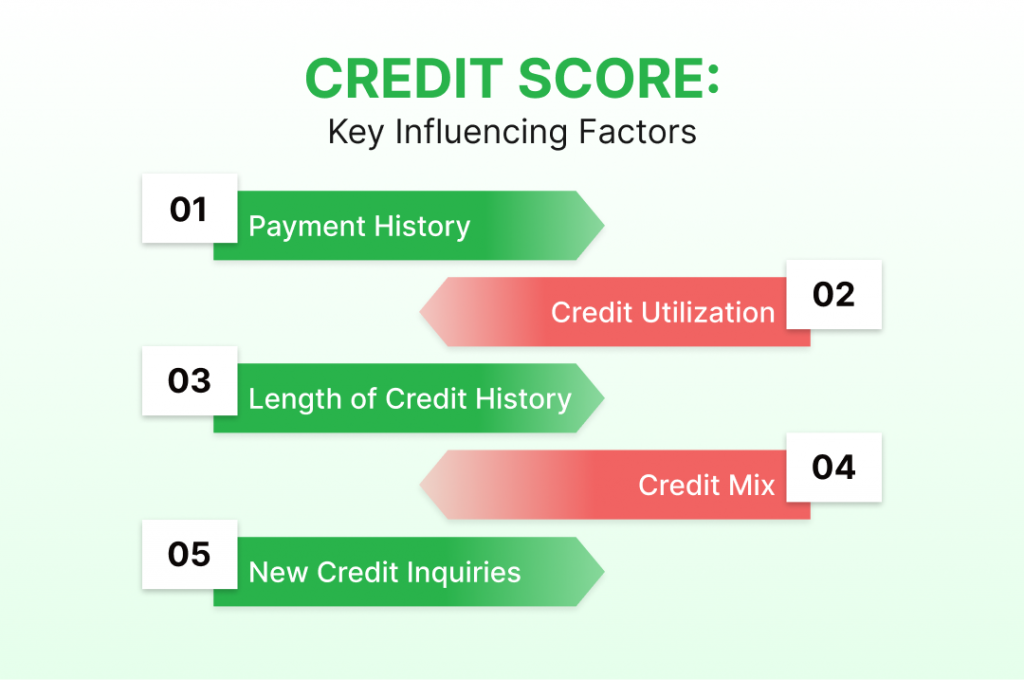

Smart Credit RepairHow to Calculate Credit Score: Key Influencing Factors

We cannot emphasize enough the significance of maintaining a good credit score. And to do so, you must be aware of all the ifs and buts and do's and don'ts of credit score ratings. How is credit score even calculated? What can you do to ensure a good credit score? Before all else, you must know the influencing factors of calculating credit score. So, here goes!

1. Payment History (35%)

One of the most prominent factors in your credit score is your payment history. And that's no surprise. Lenders prefer individuals who have a proven track record of paying off debt timely. So, to achieve a good credit score, prioritize paying your bills on time.

| Tip: To ensure you never miss a due date, set up reminders or automatic payments. |

2. Credit Utilization (30%)

Maintaining a low credit utilization ratio is also crucial for a good credit score. This is because a high utilization rate could indicate you're too dependent on credit. Further, it may reveal that you'll have trouble paying bills on time. Aim to keep your credit balances well below your credit limits. A utilization rate below 30% is generally recommended.

| Tip: Pay down credit card balances and avoid carrying high balances month to month. |

3. Length of Credit History (15%)

Building and maintaining a good credit history over time is beneficial. Moreover, a prolonged credit history helps demonstrate your ability to pay off debt. So, keep older accounts open, even if you don't use them regularly, as they contribute to your average credit age.

| Tip: Be cautious about closing your oldest accounts, as it can shorten your credit history. |

4. Credit Mix (10%)

A diverse mix of credit types can positively impact your score. So, try to mix things up when applying for credit. Consider having a combination of credit cards, installment loans (e.g., a mortgage or car loan), and retain accounts if it makes financial sense.

| Tip: A mix of revolving and installment credit makes for a perfect duo as it demonstrates your ability to manage different debt types. |

5. New Credit Inquiries (10%)

Be mindful while applying for new credit. Try to limit the number of new credit applications, especially within a short period. When you apply for credit, it reflects as hard inquiries on your credit report, and takes your credit score down, even if by a few points. Even if you're just checking for eligibility, be careful.

| Tip: Only apply when and for what you really need. |

Additional Influencing Factors

- Public Records and Negative Information: These can drastically harm your credit score. So, try your best to avoid bankruptcies, foreclosures, and liens. Further, avoid accounts in collection, which should be resolved.

- Credit Report Accuracy: Review your credit reports regularly to ensure they are accurate. Errors can harm your score, you can dispute credit repair inaccuracies. CoolCredit's AI can help you generate dispute letters to the credit bureaus and guide you through the process.

- Financial Responsibility: Exhibiting responsible financial behavior and being wise with your budgeting can also help maintain a good credit score over time.

Why Credit Scores Differ for Different Credit Bureaus: Experian, TransUnion, and Equifax

- Scoring Model Used: Different credit bureaus use distinct scoring models. (e.g., FICO, VantageScore). This may lead to score differences.

- Scoring Model Versions: Even within FICO and VantageScore models, various versions are available. The use of different versions may also affect score calculations.

- Variations in Data: Credit bureaus collect data independently, resulting in variations based on what creditors report.

- Time of Reporting: Lenders or creditors may update bureaus at different times. This causes differences in the information used for calculating scores.

- Credit Inquiries: When you apply for credit, a lender may pull your credit from a specific bureau. So, the impact of the inquiry may be reflected in only one.

- Influencing Factors: Each bureau may use unique proprietary algorithms to weigh credit factors, leading to score variations.

- Geographic Variations: Regional variations in lending practices and credit reporting can lead to differences in credit scores.

- Errors and Omissions: Credit reports may contain errors or omissions, and these can vary from one bureau to another. These discrepancies can cause score variations.

Ensuring the Accuracy of Your Credit Score Ratings

| Notably, 62% of people think their credit score is higher or lower than it should be. |

Even so, not many do anything about it. Mostly due to a lack of awareness or guidance. However, that is a bad call to make in the long run. And this is where a DIY AI-assisted Credit Repair App can be of great help. One like CoolCredit. It has all the resources you need to help repair your credit (all by yourself), boost your scores, monitor changes, and keep you on track.

Additionally, it helps you easily dispute inaccurate credit details. A major challenge faced by many. It allows you to retrieve credit reports securely, identify areas of improvement, and generate dispute letters to address inaccuracies. That's not all, it also guides you through the process with its Expert Assist feature.

Conclusion

Your credit score is a vital financial indicator that can greatly impact your life, from securing loans to finding a place to live or even getting a new smartphone. Understanding the credit score ranges, factors influencing your score, and the importance of maintaining a good credit rating is essential for financial success.

Take control of your credit journey with ai credit repair. CoolCredit empowers you to monitor your scores, dispute inaccuracies, and identify areas for improvement, all while guiding you through the process.

FAQs

Q: Can You Have a Single-Digit Credit Score?

A: The short answer is no. Credit score ranges from 300 to 850, with higher scores indicating better creditworthiness.

Q: How Can I Check My Credit Score?

A: You can check your credit score for free through various credit monitoring services, such as Experian, or Equifax. You are entitled to one free credit report from major credit bureaus every 12 months through AnnualCreditReport.com. Further, you can retrieve your credit reports through entrusted DIY credit repair tools like CoolCredit.

Q: How Can I Improve My Credit Score?

A: Paying bills timely, reducing credit balances, avoiding opening too many new credit accounts, and maintaining a mix of credit types are a few ways of improving your credit score.

Q: Can I Remove Inaccurate Information From My Credit Report?

A: Yes. You can raise disputes against inaccurate credit information or details to get it removed from your credit report. You have to send dispute letters to the credit bureau to do so.

Q: FICO Score vs. Credit Score, which one is better?

A: Although 'Credit Scores' and 'FICO Scores' are used interchangeably, the latter refers specifically to a brand of credit scores. So, there is no FICO Score vs. Credit Score. Moreover, Credit Scores, as a broader term, encompass various scoring models, including VantageScore, developed by the three major credit bureaus: Equifax, Experian, and TransUnion.

Explore Similar Blogs

1. FICO Score vs Credit Score: What’s the Difference?

2. What Is a Good Credit Score, and How to Get and Keep It?

3. What Credit Score Do You Start With?

4. Credit Score 808: What It Means and How to Maximize Its Benefits